Rutherford County Property Assessor Responds

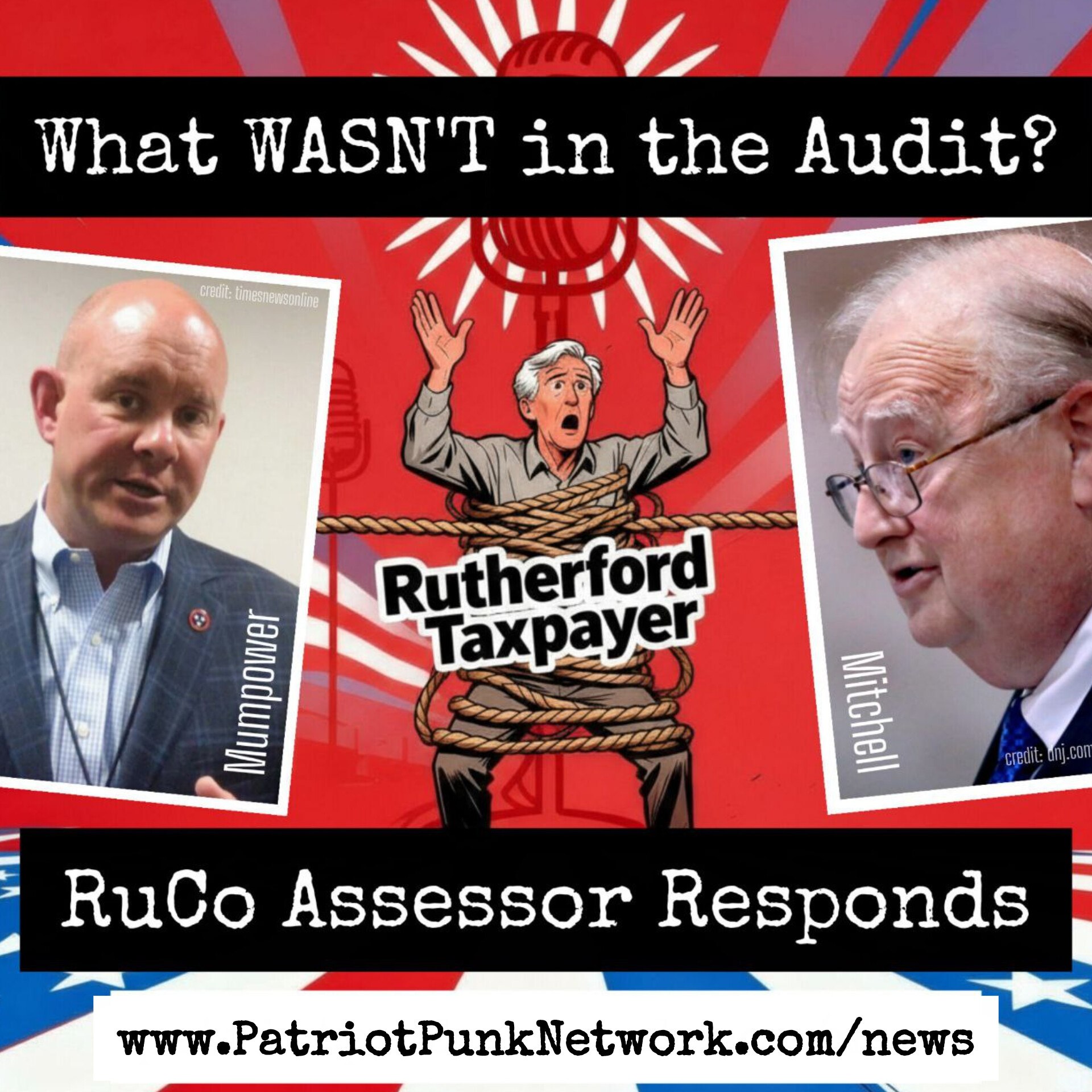

RUTHERFORD COUNTY – When Tennessee Comptroller Jason Mumpower stood before Rutherford County commissioners on October 16 and declared the county’s property assessments “a pile of sinking sand,” his warning flooded statewide headlines. What went unnoticed was the counter‑story brewing behind the scenes. A story including internal documents, statutes, and emails from the assessor himself.

Property Assessor Rob Mitchell’s correspondence and supporting exhibits paint a picture at odds with the Comptroller’s televised claims. Where Mumpower described incompetence, Mitchell says he found state‑imposed methods that ignored Tennessee law, relied on Zillow and Redfin data, and inflated property values by millions. Is there an ulterior motive to the investigation?

A Paper Trail of Contradictions

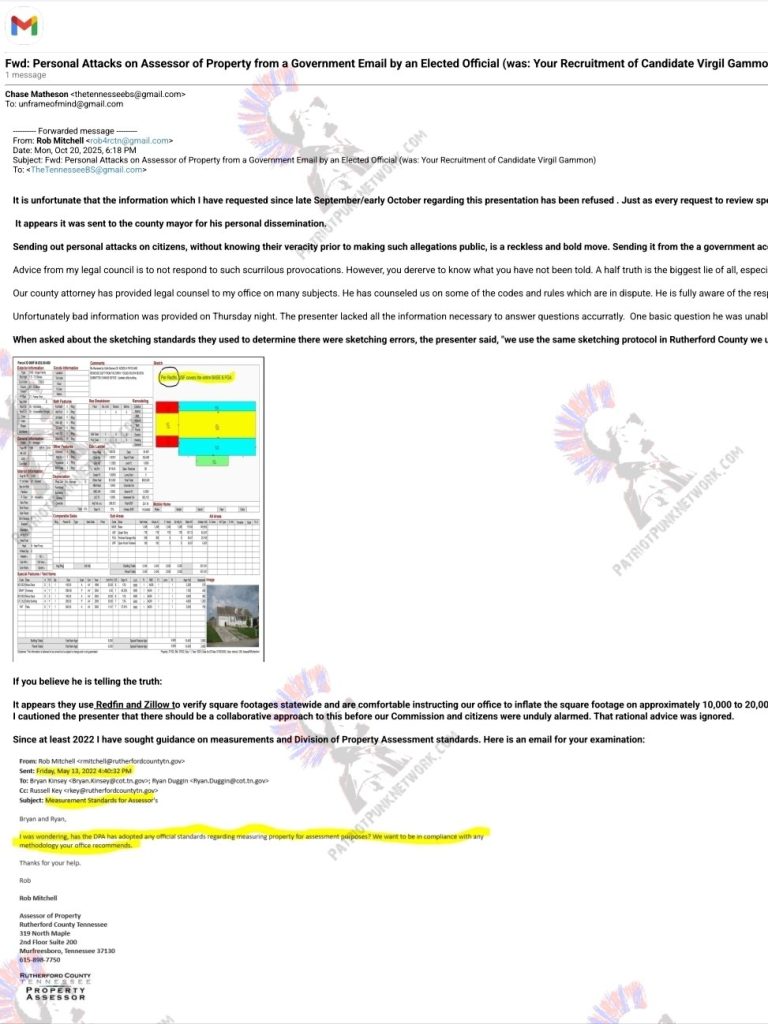

Mitchell’s October 19th email to Rutherford County commissioners, three days after the state presentation, was measured but blistering.

“It is unfortunate that the information I have requested since late September… has been refused. Just as every request to review specific accounts with the Comptroller’s staff has been denied for the last year and a half,” Mitchell wrote.

The assessor accused state auditors of using online sources instead of physical inspections and then ordering his staff to “correct” sketches to match those inflated measurements. He even provided examples.

Attached to his message were side‑by‑side examples showing that the state’s supposed errors in Rutherford County were themselves often wrong. In 25 samples the assessor reviewed, 14 (56 percent) turned out to be correctly assessed before the state intervened — an error rate opposite of what Mumpower announced publicly.

Example 1 – Redfin and Reality

In one case (parcel 068F‑B‑033.00), auditors directed Mitchell’s office to raise a home’s square footage from 2,026 to 2,806 — an extra 780 square feet — based on a Redfin listing that included an outdoor deck as interior space. Following that instruction would have artificially boosted the property’s taxable value by tens of thousands of dollars.

Example 2 – The Pool‑Cover Property

A second file (parcel 069‑014.02) shows a pool mis‑measured using aerial imagery. Auditors counted the pool cover’s footprint rather than the water itself, adding 107 square feet and classifying an unfinished porch as a finished room — a $12,655 increase in market value.

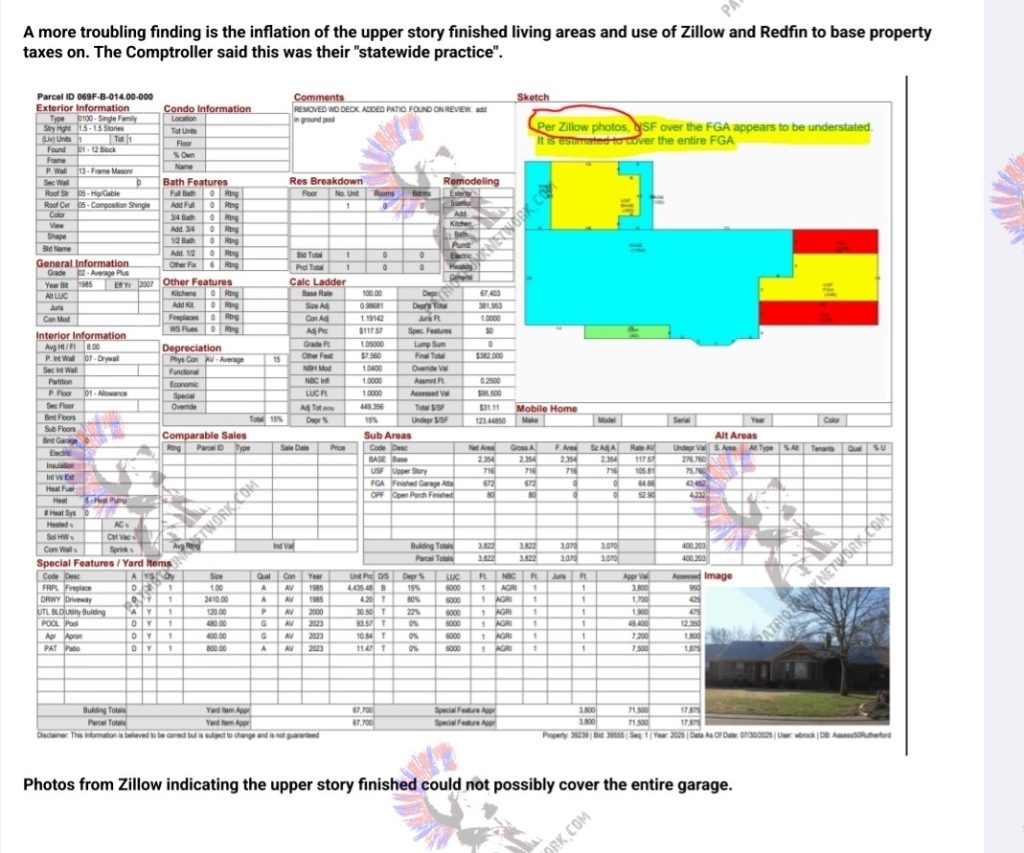

Example 3 – Imaginary Upper Floor

In parcel 069F‑B‑014.00, state staff claimed an upper story extended across the entire garage, a detail they said came from Zillow photos. County inspection proved otherwise, showing a 336‑square‑foot overstatement worth $35,552 in taxable value and $667 per year in extra taxes.

Mitchell called the situation “a Catch‑22”:

“If we key these as instructed, I will be knowingly in material violation of my oath of office. If I uphold my oath, I risk being found ‘willfully non‑compliant’ by the Comptroller.”

The Numbers Behind the Fight

Mitchell estimates that between 10,000 and 20,000 Rutherford County homes could be overstated if the state’s Zillow/Redfin‑based methodology were applied broadly — costing citizens about $13.3 million a year in inflated taxes.

He points out that his entire field staff of 12 appraisers must inspect 45,000 parcels annually and all 134,000 within four years, while the state employed 22 people for four months just to audit 8,000 properties before billing the county $234,165.

Does this justify errors? No, but it does demonstrate the shear size of the workload undertaken by all Property Assessors.

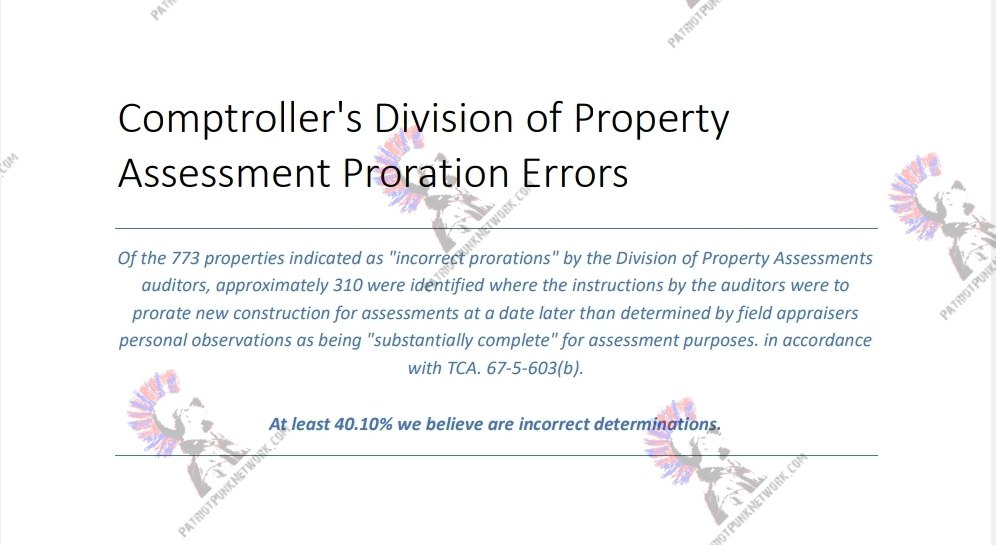

Law vs Directive: The Proration Dispute

One of Mitchell’s strongest arguments centers on Tennessee Code § 67‑5‑603(b), which defines when new construction becomes taxable — when occupied, substantially complete, or sold. Certificates of Occupancy (CO), he notes, appear nowhere in the statute.

Yet he documented 773 properties where Division of Property Assessments (DPA) auditors demanded use of CO dates as the trigger. His review found roughly 310 (40 percent) of those orders violated state law by postponing when taxes legally apply.

Example: Account #126153 was deemed taxable only after October 30, 2024 — the CO date — though field checks showed completion that May. That five‑month delay effectively erased legitimate revenue, Mitchell said.

“Nowhere in this statute or in DPA or SBOE memos is a certificate of occupancy mentioned as the threshold required.”

Ironically, Mitchell argues, while the Comptroller accused him of “pushing properties out,” the DPA’s own instructions did exactly that.

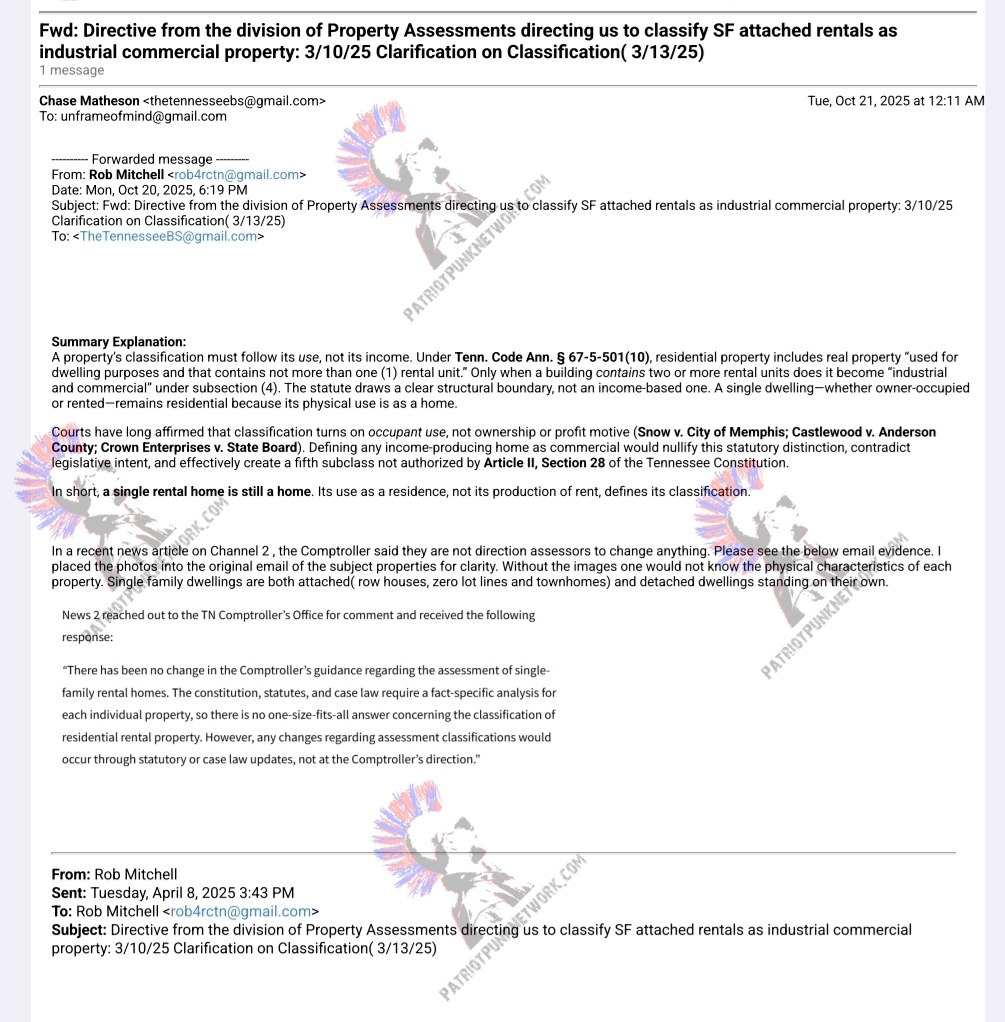

Rewriting the Rules: The Classification War

Emails from March 2025 show another behind‑the‑scenes dispute — this time over how to classify single‑family rental homes. The DPA ordered Mitchell to label attached rentals (such as townhomes) as commercial/industrial property, raising their assessment ratio from 25 to 40 percent. This would allow for an increase in property tax revenue without a need for re-assessments or increased taxes, a move that would almost certainly raise the cost of living for renters in Rutherford County.

Mitchell pushed back, citing Tennessee Code § 67‑5‑501(10), which defines residential use by occupancy, not income.

“A property’s classification must follow its use, not its income.”

He warned the directive could create an unconstitutional “fifth subclass” of real property statewide.

A Matter of Access and Transparency

Mitchell maintains the dispute escalated because the state withheld information for more than a year. Requests to review flagged parcels went unanswered until the very week of Mumpower’s public presentation.

Two commissioners later asked that a final written report be released to summarize the state’s findings. According to NewsChannel 5, however, a spokesperson for Comptroller Mumpower said no final report will be issued, despite earlier statements that the investigation wasn’t complete. Generally, the findings of all investigations are released on the Comptroller’s website.

For now, county officials and the public have only a public slideshow (and unanswered questions) about which “corrections” the state expects to survive review.

“Bricks Without Straw”

In another October email titled Final Value Report and Knowledge of Insufficient County Support, Mitchell invoked Exodus: > “Make bricks without straw.”

He attached staffing evaluations showing his team had neither budget nor manpower to perform what the state demanded. Yet, he added, refusing those impossible deadlines invited new accusations of non‑compliance. Another Catch-22.

Politics and Perception

Though major headlines focused on error rates, much of Rutherford County’s conflict plays out in local politics.

Earlier emails show GOP Chair Austin Maxwell accusing Mayor Joe Carr of recruiting a primary challenger against Mitchell — a charge Carr (to our knowledge) hasn’t publicly addressed. Important to note, Maxwell’s son worked for Mitchell, a point of previous public outcry.

After Mumpower’s presentation, Carr circulated the Comptroller’s PowerPoint to other officials, prompting Mitchell to respond that distributing “personal attacks” from government accounts “under color of office” was reckless.

Mitchell insists his actions have been consistent with oath and statute. “Citizens deserve honest answers and not political theater.” While other remain skeptical.

Mayor Carr was given until 5pm to respond to our questions, but failed to meet the deadline to respond.

What Happens Next

The Rutherford County Commission plans to vote in November on hiring an independent third‑party firm to reassess all 130,000+ parcels and decide whether to adopt the state’s IMPACT software (estimated $116,500 per year vs the county’s current $65,000 system).

Mumpower has described his work as “finished.” Mitchell says a real resolution will require a written record of how — and why — the state’s methods diverged from law.

Until then, homeowners remain in the dark. Are their assessments valid, overstated, or victims of politics by spreadsheet?

View the Comptroller’s presentation here. Watch our full 2 hour interview with Rob Mitchell here.

Edited to reflect that Austin Maxwell’s son no longer works for Mitchell’s office and to update the cost of the IMPACT system.

EDITORS NOTE: This article was a joint effort from both Chase Matheson (the Patriot Punk) and Daniel Wagner (Unframe of Mind).